Small businesses used to have a hard time getting approved to accept credit cards. Getting set up for a merchant account involved passing a credit check, agreeing to a long-term contract, paying monthly fees even if you didn’t accept any payments, and acquiring specialized equipment often with another monthly payment.

Brava’s Dogs in Fort Wayne can take cash, but they’ll also take payment by Square. Tip: try their lemonade. Photo by Becky McCray.

Square and its competitors have changed all that. Easy to get set up. No long-term contract. No monthly fees. “Equipment” is just your phone and a tiny plastic doohickie.

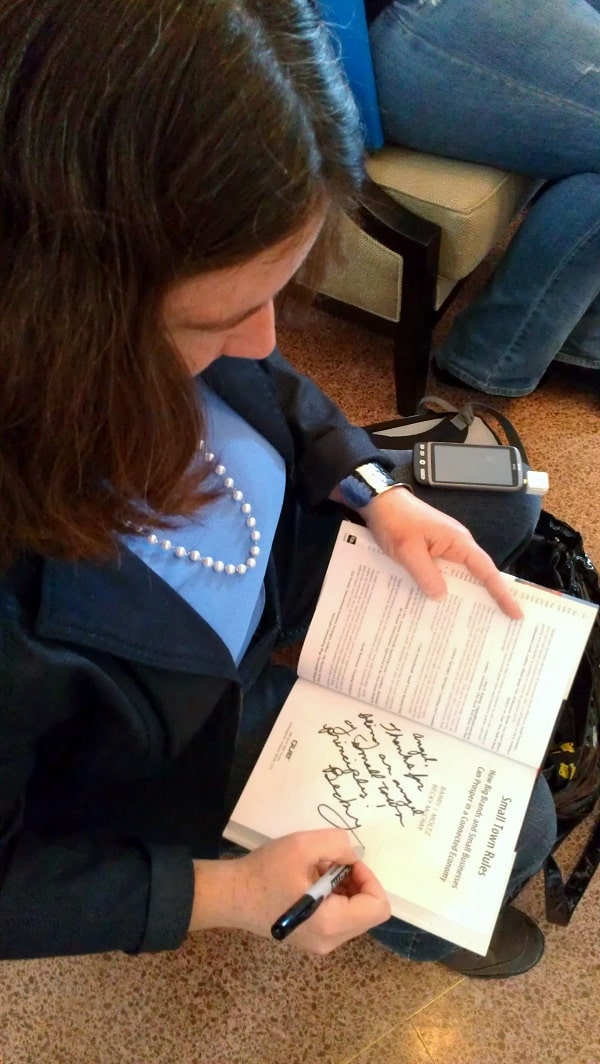

Tools of today’s book author trade: payment by Square. Photo by Sheila Scarborough, used with permission.

This has been a game-changer for small businesses, making many location-independent, letting others take cards “every once in awhile.”

- Food vendors can go mobile.

- Farm stands don’t have to get a phone line.

- Service providers can take payment on any site.

- Small town businesses aren’t constrained by the lack of local banks or merchant services.

- Fair and festival vendors can finally take cards.

At a recent conference, I had a few books on hand that I wanted to take reimbursement for. Square worked perfectly, and I even borrowed fellow speaker Sheila Scarborough‘s Square credit card reader since I forgot mine. (I already had an account, I just forgot my reader.)

Want more info? Read our Square credit card review.

Tell us in the comments: how have mobile credit card devices changed your small town business?

I love Square. We’ve got the Bartlesville Symphony Orchestra using Square. Great way for Non-Profits to collect money during fund-raising events. We are currently selling raffle tickets and collecting money via Square.

We use Square to accept donations, membership payments, event ticket purchases, etc. It’s fantastic! I just wish there were some connection to our community bank that we love and is so supportive of our community and our organization. Also, Becky, great job with working “doohickie” into a post! ;-)

Great examples, guys! And thanks, Joe, for catching the “doohickie” reference after we talked about it on Twitter. :)

I wonder if local banks could create their own version of Square and their competitors? Or if they could join the Dwolla network? Hmmmm….

while I use a standard third party processor at my store (locked into one of those contracts you mentioned) I do have a Square account. As long as you have phone signal even if you lose electricity (like in our recent storm) it is still possible to accept cards.