Independent contractors and related tax questions are some of the most common questions we get from readers, so I was glad to see these webinars offered by the IRS Small Business/Self-Employed Division during Small Business Week.

The webinars will cover:

- What to do when you hire and pay independent contractors, and

- How best to avoid common mistakes small business owners may make.

- IRS representatives will also be available for a question and answer session directly after each presentation.

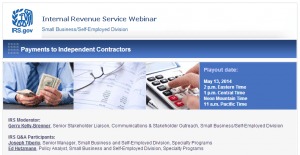

Payments to Independent Contractors

Date: Tuesday, May 13, 2014

Time: 11:00 a.m. (PT); 12:00 p.m. (MT); 1:00 p.m. (CT); 2:00 p.m. (ET)

Register: IRS Webinar Registration website

Avoiding the Biggest Tax Mistakes

Date: Thursday, May 15, 2014

Time: 11:00 a.m. (PT); 12:00 p.m. (MT); 1:00 p.m. (CT); 2:00 p.m. (ET)

Register: IRS Webinar Registration website

Interested but can’t attend?

These webinars will be placed online for later viewing on the IRS Video Portal approximately three weeks after the date of the event.

The IRS provides more useful tax related information online:

- IRS Tax Information for Business

- Small Business and Self-Employed Tax Center

- Small Business Taxes: The Virtual Workshop

[…] is usually paid by the job. However, it's common in some professions, such as law, to pay independent contractors […]