If you’ve started a new business during the past year, you may be wondering how to file your first tax return as a sole proprietor. Here’s the run-down for businesses in the USA.

How do you know if you’re a sole proprietor? If you haven’t incorporated, you are a sole proprietor. If you formed an LLC, you were supposed to declare whether you wanted it to be treated as a corporation or a sole proprietor. Still not sure? Time to check in with a professional.

The Questions

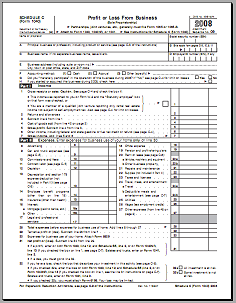

The Schedule C tells you exactly what questions you’ll need to answer. Even if someone else will be preparing your return, download a copy of the 2008 Schedule C and study it. That’s how you figure out what numbers your tax preparer will need.

One of the first questions is your accounting method. Unless you have a good reason to be different, you are on the cash basis. That means you count transactions when they actually hit your hand. The alternative is accrual, where you count income as soon as you invoice the customer. This is another good question to discuss with a professional.

Part I for Income is pretty straight forward. In most cases, all your sales go in gross receipts.

Pay special attention to Part II where it lists Expenses. The categories are more broad than what you’re likely tracking. For example, all the utilities are lumped together on Schedule C, even though you probably track phone expenses separate from internet access.

If these last three sections apply, they call for a bit of professional advice. If you sell goods, Part III walks through the cost of goods you sold during the year. Part IV is for vehicle expenses, if you drove some business miles last year. Part V covers oddball expenses that you didn’t work into the existing categories in Part II.Our tax expert Glenna Mae Hendricks, E.A., strongly suggests you avoid creating new items for Part V. It’s better to find a place in Part II that it fits than to invite extra scrutiny in Part V.

Records to collect

Besides providing your preparer with the totals, you’ll want to be able to prove how you got them. That means documenting the transactions that add up to those totals. If you’re using QuickBooks or another computer system, you can print out the transaction reports. If you used Glenna Mae’s envelope accounting system, you already have the answers on your summary sheets. If you don’t have a system, …. aren’t you ready to get one going for this year?

This article is part of the Small Biz 100, a series of 100 practical hands-on posts for small business people and solo entrepreneurs, whether in a small town, the big city, or in between. If you have questions you’d like us to address in this series, leave a comment or send us an email at becky@smallbizsurvival.com. This is a community project!

New to SmallBizSurvival.com? Take the Guided Tour. Like what you see? Get our updates.