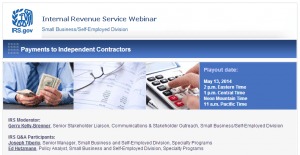

Independent contractors and related tax questions are some of the most common questions we get from readers, so I was glad to see these webinars offered by the IRS Small Business/Self-Employed Division during Small Business Week. The webinars will cover: What to do when you hire and pay independent contractors, and How best to […]

IRS? There’s an app for that

Waiting on an income tax refund? Wondering about the status of your tax return? The IRS has an app for that, IRS2Go. In fact, the IRS has had an app since 2011, and the new version 4.0 is now available in both English and Spanish, for iPhone and Android. Refund status info is updated daily, not minute-by-minute […]

IRS Tax Calendar for Small Business and Self-Employed

IRS Tax Calendar for Small Businesses and Self-Employed, has been discontinued after 2013. This was the printed wall calendar that used to list the due dates on the pages of each month. However, the IRS said that an IRS Tax Calendar and most of the information previously contained on it can be found at www.irs.gov/taxcalendar. The calendar dates […]

2014 Standard Mileage Rates for Business, Medical and Moving Announced

Beginning on Jan. 1, 2014, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven 23.5 cents per mile driven for medical or moving purposes 14 cents per mile driven in service of charitable organizations The business, medical, and moving […]