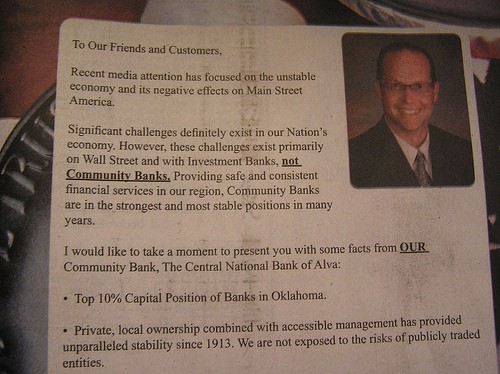

The Small Town Rules secret is out: small town banks know a lot of things big banks don’t. Bloomberg Businessweek author Brendan Greely picked up on it in a story, “Rural banks know something big banks don’t.”

“It turns out small, rural banks make smarter loans,” Greely said. It’s the soft knowledge, the un-quantifiable personal factors, that make smarter loans. And community banks excel at knowing the people. It also helps that rural bankers face their borrowers and investors daily in the community.

“We don’t make bad loans,” Louisana community banker Albert Christman says. “They’re way too expensive to do.”

New regulations aimed at bad loans in big banks are hurting small community banks, raising their overhead in a time when margins are low. The result is many rural community banks looking to expand modestly by acquiring banks in neighboring towns, but existing bankers are in no mood to sell. They’re just as invested in their local community.

Original article: Rural banks know something big banks don’t

Photo: 2008 ad from a Community Bank in Alva, Oklahoma. Photo by Becky McCray.